Past events

The US perspective on Pillar one and Pillar two: a conversation with key American actors

The Tax and Transfer Policy Institute is running a ‘special seminar’ on the US perspective on Pillars one and two of the OECD BEPS process.

A study of cross-border profit shifting channels

In this seminar, we investigate two cross-border profit shifting channels of foreign multinational enterprises (MNEs) in Australia.

Australia's future: tax, productivity and federation

The Tax and Transfer Policy Institute and the Business Council of Australia are conducting a half-day workshop on the three key, post-COVID reform priorities for Australia.

Mental health and duration off income support

This seminar uses Australian administrative income support data to look at how long people stay off income support when they leave unemployment benefits.

Deductions for work-related expenses in Australia: an analysis of options for reform

This seminar is an analysis of reform options for work related expense (WRE) deductions for individual taxpayers in Australia.

A study of profit shifting using the Hines and Rice approach

Adopting and modifying the approach used by Hines and Rice (1994), we investigate the extent of cross-border profit shifting activities by foreign-owned Australian companies (FOACs).

COVID-19, Gender and Work: Policy, Risk and Opportunities for a gender responsive recovery

The Social Policy Institute at the Crawford School of the ANU runs a series of workshops exploring major social policy concerns.

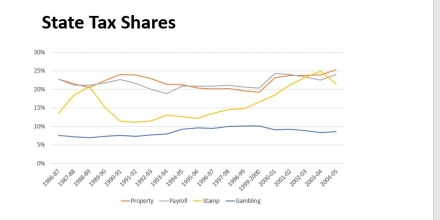

2000: A new tax system

In 1995, John Howard, the newly elected leader of the Opposition, reflected on the Coalition’s loss of the 1993 federal election.

What happened to the Australian labour market in the Covid-19 pandemic in retrospect and prospect

The Social Policy Institute at the Crawford School of the ANU runs a series of workshops exploring major social policy concerns.

1985 reform of the Australian tax system

After the tumult of the Whitlam government, the Fraser government (1975-1983) saw consolidation with less reform.

Pages

Updated: 21 November 2024/Responsible Officer: Crawford Engagement/Page Contact: CAP Web Team